In the intricate intersection of technology and global politics, the semiconductor industry has emerged as a battleground, giving rise to what can be aptly termed as the Silicon Struggles.

This multifaceted landscape encompasses the industry challenges and geopolitical complexities that define the contemporary semiconductor arena. The global leadership in key aspects of the semiconductor ecosystem is currently held by the United States and a select group of partners and allies such as Germany, Japan, Netherlands, South Korea, and Taiwan. As nations vie for dominance in semiconductor research, development, design, and manufacturing, a geopolitical maze unfolds, presenting a myriad of obstacles and opportunities.

The US faces increasing challenges, finding itself in the pendulum shift, and its once clear advantages are gradually diminishing. The semiconductor shortage[1] has become a focal point for understanding the intricate interplay of technological complexities and far-reaching economic repercussions that resonate across diverse industries worldwide, and by adding the geopolitical dimensions of this trend, security issues also come to the front.

How can we help?

Intelligence Solutions

The combination of business, market and strategic intelligence ensures result-driven outcomes for our customers.

Risk management

Risk management through the responsibility of taking risk ownership while ensuring safety and security

Strategic Advisory

The first step in protecting your organization, assets and people is the identification of the risks and threats.

The impact of the semiconductor shortage on the world economy is profound, evident in examples such as the estimated USD 240 billion reduction in US GDP in 2021.[2] Currently, the US faces increasing challenges finding itself in the pendulum shift, and its once clear advantages are gradually diminishing. This scarcity has rippled through various sectors, underpinning the contemporary global economy, ranging from artificial intelligence (AI) and machine learning to biotechnology, quantum computing, self-driving vehicles, and the Internet of Things, causing disruptions and economic fallout. The semiconductor industry, often overshadowed by its technical intricacies, is in fact a linchpin enabling economic activities valued in the trillions of dollars annually. Consequently, the shortage has laid bare the sector’s pervasive influence, underscoring its critical role in the global economy.

As we delve into the ramifications, it becomes clear that the damage to the semiconductor supply chain has significant consequences for the future of the digital age. These vulnerabilities touch upon various aspects of state functions highlighting the need for a more resilient and adaptable framework to navigate the complexities of the digital era. The following research emphasizes the importance of this omnipresent technology, analyses the factors that are shaping the global scarcity, how stakeholders will need to respond to the threats, and how it affects the industry, followed by a forward-looking analysis aiming to inform policymakers and CEOs on what to expect and how to navigate to the challenges brought by the semiconductor supply chain shortage.

01

Unveiling the World of Semiconductors

01

Unveiling the World of Semiconductors

Taiwan is a center of gravity in the semiconductor’s supply chain. In forecasting and adjusting future operations, it is crucial that companies understand the geopolitical implications involving Taiwan.

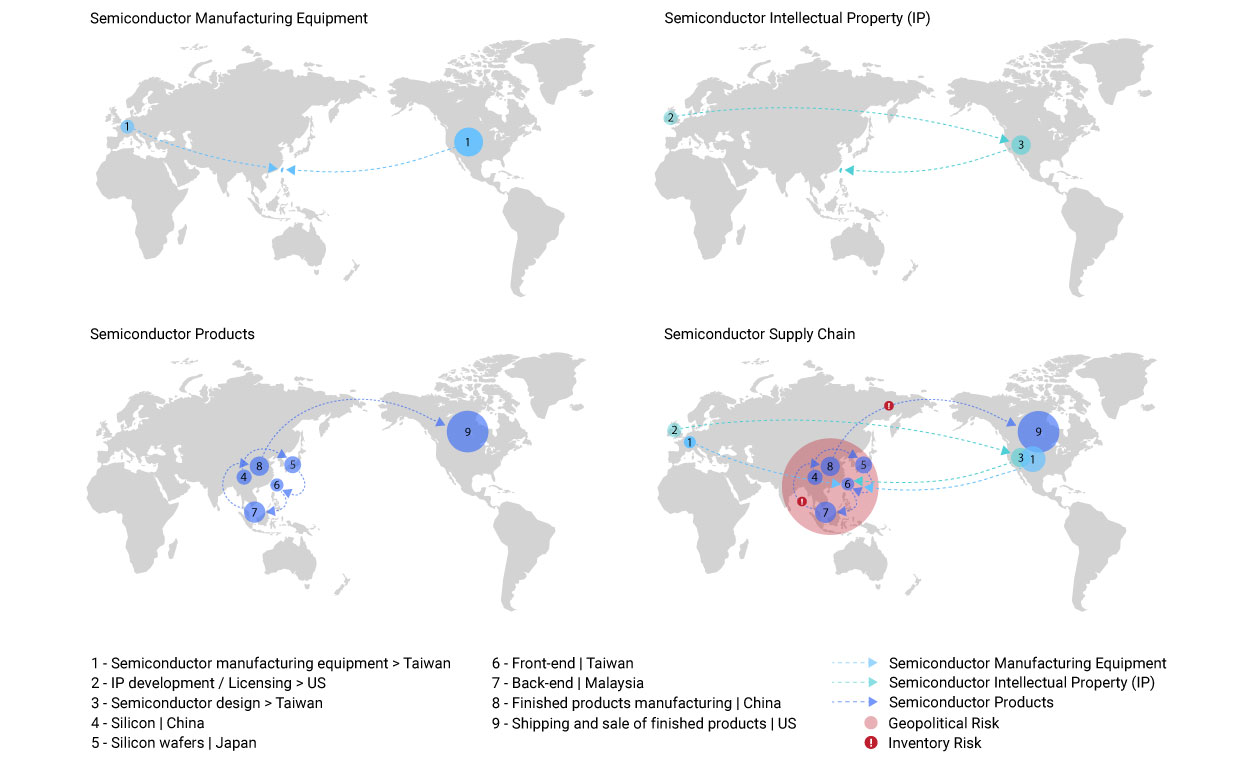

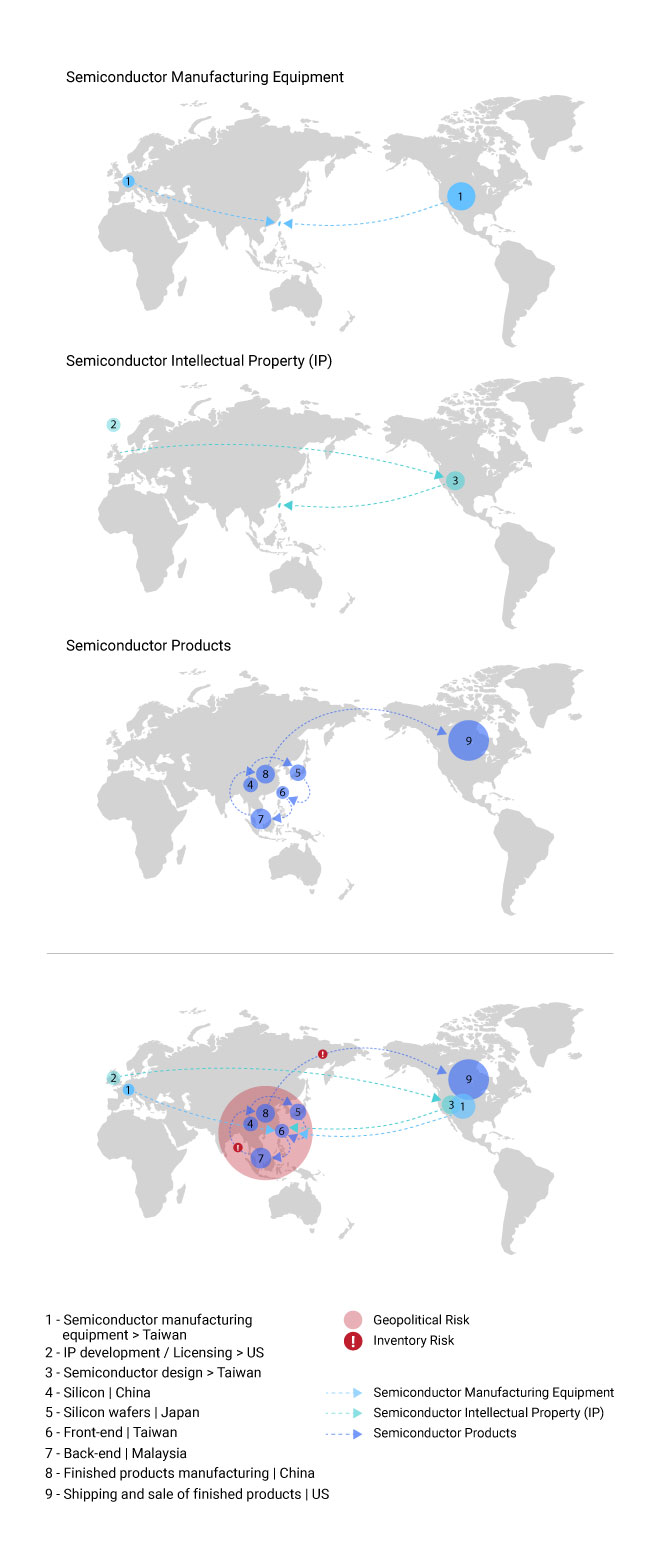

Semiconductors, often referred to as integrated circuits or computer chips, are fundamental components in modern electronic devices. These omnipresent microscopic gadgets are made from semiconductor materials, typically silicon, and are found in data centers, laptops, mobile phones, automobiles, and household appliances. These gadgets are even utilized in critical infrastructure such as nuclear missile guidance systems, defense systems, and electrical grids as well.[3] Therefore, one can safely assume that semiconductors play a pivotal role in shaping the technological landscape of the modern era. The semiconductor supply chain on the other hand, is a sophisticated and globalized network comprising several key stages. Namely, the initial phase involves the design and development of semiconductor chip architecture, a process led by the United States, which until recently dominated the global market with over 40 percent of the share in integrated circuit design, electronic design, automation software, semiconductor intellectual property, and design services.

However, the current US administration reveals the substantial erosion of the country’s dominance in this crucial industry, exemplified by the significant decline in the US’ semiconductor manufacturing prowess over the past few decades, which currently translates to ten percent of the worldwide semiconductor supply.[4] Once the chip design is complete, the process moves to the fabrication stage, which involves intricate production procedures utilizing precise machinery from a limited number of global suppliers. The production currently is mainly located in Taiwan, a critical player in semiconductor fabrication, which accounts for 65 percent of the global demand for semiconductors and a staggering 90 percent of the demand for advanced semiconductors.[5] There are also other players in the semiconductor supply chain who play a significant role, however, the research highlights Taiwan’s role as the most significant due to the geographic localization of the production processes (fig.1). Further assessment will touch upon the most influential factors relevant to the semiconductors’ supply chain.

Figure 1: Semiconductor Value Chain[6]

However, the current US administration reveals the substantial erosion of the country’s dominance in this crucial industry, exemplified by the significant decline in the US’ semiconductor manufacturing prowess over the past few decades, which currently translates to ten percent of the worldwide semiconductor supply.[4] Once the chip design is complete, the process moves to the fabrication stage, which involves intricate production procedures utilizing precise machinery from a limited number of global suppliers. The production currently is mainly located in Taiwan, a critical player in semiconductor fabrication, which accounts for 65 percent of the global demand for semiconductors and a staggering 90 percent of the demand for advanced semiconductors.[5] There are also other players in the semiconductor supply chain who play a significant role, however, the research highlights Taiwan’s role as the most significant due to the geographic localization of the production processes (fig.1). Further assessment will touch upon the most influential factors relevant to the semiconductors’ supply chain.

Figure 1: Semiconductor Value Chain[6]

02

Factors Shaping the Semiconductor Supply Chain Landscape

02

Factors Shaping the Semiconductor Supply Chain Landscape

The US-China geopolitical competition significantly shapes the dynamics of the global semiconductor market, as seen from the export controls and restrictions on chip transfers to China by the US, Japan, and Netherlands, driven by national security concerns, affecting the strategic positioning of states in the global economy.

The semiconductor supply chain is molded by a complex interplay of factors that extend beyond technical intricacies and contribute to disruptions resulting in the creation of a domino effect on various industries, consequently influencing the world economy. The most important risk factors influencing the semiconductors supply chain are geopolitical tensions, ESG considerations, COVID-19, the continuous pace of innovation alongside collaborative initiatives, as well as the global response to the challenges related to the semiconductor supply chain.

Geopolitical tensions, as exemplified by the situation between China and Taiwan, introduce a significant element of risk, given the concentrated production of advanced chips in specific regions. The first critical factor which raises concerns about supply chain vulnerability and intricately shapes the semiconductor supply chain is the concentration of chip manufacturing in specific regions, notably Taiwan. The emphasis on the importance of geographic diversification and resilient supply chain strategies reveals that such approaches are crucial to minimizing the impact of geopolitical events on the global economy.

Furthermore, policymakers are also playing a role with initiatives like the US CHIPS and Science Act from 2022, a USD 52.7 billion initiative, which aims to revitalize US chip manufacturing prioritizing national security needs, reflecting a growing recognition of the semiconductor supply chain’s strategic importance. In fact, an entity poised to address these challenges already exists. In September 2022, US, Japan, South Korea, and Taiwan established a collaborative initiative known as the “Fab 4 Alliance” or “Chip 4,” designed to foster coordination and cooperation among governments and manufacturers within the entire spectrum of the semiconductor supply chain. Despite sporadic meetings since its formation, the alliance has yet to manifest as a tangible and visible structure.

In addition, political tensions, exemplified by geopolitical conflicts between states, bear the potential to disrupt the flow of raw materials and impact manufacturing facilities, creating bottlenecks in the supply chain. The conflict between China and Taiwan, the conflicts in other regions, and the growing rift between the West and the East create pressure for reshaping supply chain strategies. Furthermore, the Huawei-Samsung saga epitomizes the intersection of geopolitics and the semiconductor industry. Initially, Huawei surpassed Samsung in global smartphone sales in 2020, but the US government’s ban on chip sales to Huawei, citing security concerns, led to a dramatic 85 percent decline in Huawei’s sales by 2022.

The ban, part of the US-China trade war, highlighted the pivotal role of chips in modern technology and their strategic importance, and both Trump and Biden administrations intensified chip-related sanctions, showcasing how control over this technology has become a geopolitical tool with profound implications for global tech leaders and international power dynamics. ESG considerations further underscore the vulnerability of the supply chain, amplifying the importance of geographical diversification. On an international scale, governmental initiatives, like the CHIPS Act in the US, reflect an external force shaping the semiconductor landscape. These policies aim to bolster domestic semiconductor manufacturing capabilities, responding to the realization that semiconductor technology is integral to national security and economic resilience.

Download Report

Silicon Struggles: Navigating the Geopolitical Maze of Semiconductor Challenges

In the intricate intersection of technology and global politics, the semiconductor industry has emerged as a battleground.

As semiconductor manufacturing is a water-intensive process, it typically requires significant amounts of water for various stages, including cleaning, cooling, and chemical processes. For instance, climate change, as demonstrated by events like the 2021 and 2023 drought in Taiwan, affected the semiconductor industry at its very core of production and underscored the vulnerability of the supply chain to environmental factors since the process requires increasing amounts of water as the technology advances forward. Even fires at manufacturing plants exacerbate the semiconductor supply chain, evidenced by the 2021 event that occurred at the automotive chip manufacturer Renesas Electronics, based in Japan, which basically destroyed the factory’s equipment. Subsequently, because of the fires, the company announced monthly losses amounting to approximately USD 160 million, and Japanese automobile manufacturers saw their shares slashed the next week. In this context, the increasing pressure from regulators and customers for sustainability and responsible sourcing of raw materials, including rare and precious minerals, adds another layer of complexity to the industry’s operations.

The COVID-19 pandemic also played a role and caused disruptions in near-term supplies of semiconductors, which resulted in global shortage of this valuable component. The increased demand for technology like computers and smartphones during lockdowns strained the supply chain and exposed its intricate global nature. Workforce shortages, factory closures, and logistical challenges disrupted production plans have all contributed to delays and shortages, and the just-in-time nature of the industry exacerbated the impact. For instance, the semiconductor shortage in the automobile industry, according to S&P Global Mobility’s analysis reveals substantial global light-vehicle production losses in 2021, exceeding 9.5 million units due to semiconductor shortages, with the third quarter of 2021 witnessing the most significant impact, accounting for a volume loss of 3.5 million units. In 2022, an additional three million units were affected. The post-pandemic world emphasized the need for resilient supply chain strategies, leading to proposed initiatives such as increased domestic manufacturing, strategic stockpiling, and enhanced collaboration among industry stakeholders to build a more robust semiconductor supply chain in the face of global crises.

Collaborative initiatives between nations addressing the semiconductor shortage, such as the North American Semiconductor Corridor,[7] underscore the external influence of geopolitical and economic dynamics. It is evident that government policies and investments, epitomized by the CHIPS and Science Act,[8] significantly influence supply chain growth. Moreover, as per Moore’s Law, the relentless pace of innovation propels companies like TSMC, Samsung, and Intel to continuously push the boundaries of chip manufacturing technology. Investments in research and development, production capacity, and the ability to adopt cutting-edge processes become internal determinants of competitiveness. Furthermore, the semiconductor industry’s response to global challenges, such as supply chain shortage, also acts as a key factor. The decisions of companies like TSMC to establish manufacturing facilities in the US and Intel’s strategic focus on enhancing domestic manufacturing capabilities reflect internal strategies to mitigate external risks and challenges.

03

Analyzing the Response

03

Analyzing the Response

The US, as a world leader, is a driving force executing risk mitigation strategies, protecting its national interests and global semiconductor supply chain. States and companies should adjust their strategies accordingly.

In formulating strategic plans and investment decisions, companies and consumers face various risks inherent in the dynamic global landscape, such as geopolitical uncertainties, economic volatility, rapid technological advancements, regulatory changes, and environmental and social factors. Therefore, it becomes clear that semiconductor shortages necessitate multifaceted industry interventions with a focus on new regulations followed by diversification of the manufacturing locations, as well as the strategic collaborative initiatives that span technological innovation, talent development, and resilient supply chain management. In the short term, these steps will likely mitigate the risks since the ripple effects are felt in multiple domains, with disruptions threatening to spread to broader technological advancements.

New regulation controls specifically alleviate the vulnerabilities of semiconductor supply chain shortage. The US has implemented a comprehensive strategy to address the global semiconductor shortage, with the CHIPS and Science Act at its core. This landmark legislation not only recognizes the critical role of semiconductors in various industries but also lays out a roadmap for revitalizing domestic semiconductor production and innovation. The CHIPS Act’s implementation is well underway, marked by considerable progress from the CHIPS Program Office and the establishment of the North American Semiconductor Corridor. Through various funding opportunities, including a proposed rule for “guardrails” and environmental questionnaires, semiconductor companies are encouraged to submit applications. This initiative is designed to provide incentives for constructing or expanding fabrication facilities, manufacturing equipment, and materials, addressing diverse aspects of the semiconductor supply chain.

How can we help?

Intelligence Solutions

The combination of business, market and strategic intelligence ensures result-driven outcomes for our customers.

Risk management

Risk management through the responsibility of taking risk ownership while ensuring safety and security

Strategic Advisory

The first step in protecting your organization, assets and people is the identification of the risks and threats.

Furthermore, the National Semiconductor Technology Center, authorized by the CHIPS and Science Act, emerges as a pivotal component. While its structure is still evolving, the Center signifies a commitment to advanced semiconductor research, design, and prototyping, reflecting the US’ commitment to staying at the forefront of semiconductor technology. In addition, the introduction of a 25 percent advanced manufacturing investment tax credit, coupled with grants, demonstrates the US’ intent to bridge the cost gap between domestic and international investments in the semiconductor ecosystem. This financial incentive aims to boost economic benefits, strengthen national security, and enhance technological leadership.

Simultaneously, these steps would be much easier to accomplish with a highly skilled workforce, however given the US estimated shortage of 27,000 highly skilled workers in the next 5-10 years. Allocating substantial amounts of funds, the CHIPS Act outlines provisions for skills development, emphasizing the importance of STEM education and short-term modifications to immigration policies to meet immediate industry demands. Recognizing the workforce challenges exacerbated by the shortage, the US has commissioned a report emphasizing the need to address skilled labor shortages in the industry. The proposed strategies include supporting regional partnerships, fostering STEM education, and attracting international engineering talent.

Diversification of semiconductor manufacturing locations emerges as one pivotal strategy and is exemplified by the vulnerability exposed in the event of black swan events involving Taiwan. The dominant role of TSMC and Samsung in chip manufacturing underscores the concentration of production in these regions, which presents challenges for other regions like Europe, where semiconductor manufacturing lacks industry leaders, raising questions about technological sovereignty and resilience in the face of global supply chain disruptions. As a result, TSMC has responded with strategic acumen, opting to transplant elements of its operational apparatus to the United States, strategically capitalizing on the imperative to cultivate a reservoir of skilled personnel by dispatching US hires to Taiwan for a comprehensive training regimen spanning 12 to 18 months.

In fact, TSMC is investing significantly to expand its facilities, aiming to meet the surging demand for semiconductors, evident from the initiated construction of two plants in Arizona, US, by TSMC, which is expected to start the manufacturing process in 2025. TSMC’s strategic move would bolster the company’s adeptness and bridge the analog design gap that Taiwan seemingly grapples with, all the while leveraging the proximity to major US clients such as Apple, NVIDIA, and Qualcomm as a pivotal factor influencing this strategic relocation decision.

Concurrently, the narrative unfolds to encompass Intel, which has also announced plans to construct new factories, in locations such as Arizona, Ohio, Oregon, New Mexico, Poland and Germany as well signaling a transformative phase to bolster domestic manufacturing capabilities and address the prevailing chip shortage. Another crucial step in diversification involves substantial investment in research and development, echoing Intel’s ambitious plan to inject billions of dollars over the next five years, aiming to regain technological leadership and pioneer advancements crucial for future applications, notably in AI. As the industry deals with these transformations, geopolitical dimensions come to the fore, highlighting the vulnerability associated with an over-reliance on TSMC and underscoring the global imperative for stakeholders to invest substantially in semiconductor manufacturing.

Evidently, the concentration of production in specific regions has proven susceptible to disruptions. Therefore, exploring alternative manufacturing hubs and reducing reliance on a limited number of suppliers undoubtedly enhances the resilience against unforeseen challenges.

Collaborative initiatives led by the US have become an imperative in the semiconductors supply chain risk mitigation. States and industry leaders reveal that global cooperation is paramount to ensure a resilient supply chain, given the interconnected nature of the semiconductor industry. The potential consequences of a blockade or conflict in the South China Sea underscore the importance of cooperative efforts to manage risks and maintain the uninterrupted flow of semiconductor components.

The US acknowledges the interconnectedness of the semiconductor industry and actively engages in cooperative efforts through the World Semiconductor Council and the World Trade Organization, platforms that facilitate global industry cooperation, promote market access, and encourage international collaboration to address such challenges collectively. Similar measures are being implemented in South Korea, Japan, and the European Union, reflecting a global recognition of the semiconductor industry’s critical role and the need for concerted efforts to fortify supply chains. Intel CEO’s announcement of building new factories and investing billions of dollars to increase capacity reflects a long-term strategy to alleviate the shortage, and alongside the US administration’s commitment to allocating substantial amount of funds for boosting chip production in the country, underscores the recognition of the semiconductor industry’s critical role in global economic stability as well as national security issues.

Likewise, the formation of “Chip 4″ exemplifies efforts to foster coordination and cooperation across the semiconductor supply chain, with an objective to enhance communication and teamwork among governments and chipmakers, offering a potential avenue to mitigate supply chain vulnerabilities. In addition, strategic stockpiling is also gaining attention as a risk mitigation strategy. Companies like Toyota and Huawei, anticipating potential disruptions, have taken proactive measures by building semiconductor inventories ahead of time aiming to buffer against sudden supply chain disruptions, and ensuring a more stable production flow.

To sum it up, the semiconductor shortage underscores the intricate interplay of a range of factors shaping the industry’s dynamics. From geopolitical tensions and economic fluctuations to technological advancements and regulatory landscapes, the semiconductor sector navigates a complex web of challenges and opportunities. Fostering resilience demands strategic foresight, adaptive planning, and initiative-taking risk mitigation measures. As companies and consumers chart their courses in this ever-evolving landscape, a comprehensive understanding of the multifaceted risks and their implications becomes paramount. The semiconductor industry’s ability to address these challenges will not only define its short-term recovery, yet will also shape its long-term trajectory, influencing global technological advancements and economic landscapes. As key stakeholders are taking action to mitigate the risks of the semiconductors supply chain shortage, there are nevertheless threats worth considering that would assist concerned actors in managing the implications of this scarcity.

04

Navigating the Ramifications

04

Navigating the Ramifications

Taking into consideration that governments have put the semiconductor industry and the supply chain shortage high on their national strategy agenda, CEOs ought to closely observe and adjust their strategic planning according to the geopolitical dynamics.

The world of semiconductors, intricately linked to global economic dynamics, technological advancements, and geopolitical considerations, has far-reaching implications and has cast a shadow over various industries, ultimately impeding global economic recovery. In this context, capacity-building initiatives and geopolitics resurface as critical issues for decision-makers to mitigate risks coming from the semiconductor supply chain shortage.

Capacity Building Initiatives

Navigating the ramifications demands a strategic focus on capacity-building measures to enhance resilience and ensure sustained access to critical technologies. Governments and industry stakeholders must prioritize investments in semiconductor manufacturing capabilities, fostering innovation and self-sufficiency. The implementation of initiatives like the CHIPS and Science Act, which provides incentives for semiconductor research and manufacturing, exemplifies an initiative-taking approach to bolstering domestic capacity. Strategic collaborations between public and private sectors, coupled with targeted investments, can stimulate the establishment and expansion of semiconductor fabrication facilities.

Additionally, there is a need for a comprehensive workforce development strategy to address skill shortages, ensuring a pipeline of skilled professionals in semiconductor design, manufacturing, and research involving educational reforms, partnerships with academic institutions, and initiatives to attract and retain talent in the semiconductor industry. International cooperation is also crucial in sharing best practices, preventing redundancies, and collectively addressing the global demand for semiconductors. Moreover, the establishment of research and development centers, such as the US National Semiconductor Technology Center,[9] has a key role in advancing semiconductor technologies, thereby contributing to capacity building and technological leadership.

One of the most severely impacted sectors, as previously noted, is the automotive industry, where production suspensions and slowdowns have become commonplace among major players such as GM, Toyota, Ford, Volkswagen, Honda, and others.[10]

However, in the first half of 2023, losses in the automobile industry attributable to semiconductor shortages notably decreased to around 524,000 units globally. While the availability of semiconductors continues to be limited, the improved predictability has empowered automakers to modify production schedules, leading to reduced instances of disruptions. However, despite marked improvements in production and sales in 2023, the pre-pandemic trajectory has been setback by approximately a decade, with the semiconductor crisis being a significant contributing factor. Another unique vulnerability of the automotive supply chain is the procurement of chips at the exact time of assembly without reserves for the future, resulting in significant financial losses for automakers and raised concerns about the industry’s resilience in the face of these challenges. Besides, such shortage reduces the short-term forecasts for recent sales, which additionally pushes the price cap up for new vehicles, potentially dampening automobile sales.[11]

Geopolitical Considerations

In context of geopolitics, the semiconductor shortage takes on an added dimension, intertwining with geopolitical dynamics and global security concerns, which places Taiwan in the geopolitical spotlight. Certainly, China is implementing a comprehensive set of significant industrial policies[12] aimed at cultivating these capacities, intending to ensure that the country can autonomously foster these capabilities and avoid being in a situation where it faces challenges in acquiring essential resources due to any form of external economic sanctions. Therefore, the prospect of a large-scale conflict between China and Taiwan carries profound implications for the semiconductor industry and global geopolitics.

In the event of such a conflict, Taiwan’s economy, heavily reliant on its semiconductor industry, faces significant vulnerability. The semiconductor industry, a cornerstone of Taiwan’s economic prowess, would likely experience a temporary cutoff from the global supply chain, disrupting not only the island’s economic stability, but also reverberating across international markets. In such course of action, the US would be compelled to military intervene mainly for two reasons.

The first one being, should the US refrain from defending Taiwan, it would have a devastating effect on their alliance structures in East Asia, and the second reason would be to “bottle up” the Chinese military inside the first island chain and prevent the Chinese ability to project power into the waters of the Western Pacific. The potential military escalation involving the US, Australia, South Korea, and Japan in response to a cross-Strait war adds a layer of complexity to the semiconductor shortage scenario. These countries, key players in the semiconductor industry and major consumers of its products, would face heightened geopolitical tensions that could further strain the global supply chain.

Download Report

Silicon Struggles: Navigating the Geopolitical Maze of Semiconductor Challenges

In the intricate intersection of technology and global politics, the semiconductor industry has emerged as a battleground.

Military involvement may prompt these nations, as well as EU and other US-aligned governments, to further impose trade and investment restrictions on China, which could extend beyond the semiconductor industry, affecting various economic sectors and exacerbating the implications of the armed conflict. To make matters even worse, an outbreak of hostilities in Taiwan would likely result in the destruction of Taiwan-based semiconductor plants as a measure to prevent the technology from falling into the hands of the adversary, and unfortunately would significantly increase the possibility of nuclear confrontation.

The upcoming January elections in Taiwan are poised to significantly impact the semiconductor industry, particularly given Taiwan’s vital role as a global leader in semiconductor manufacturing. The election outcomes may shape the regulatory environment, policy initiatives, and geopolitical relations, affecting TSMC, the island, as well as the neighboring region. The aftermath of Taiwanese elections carries significant implications, particularly regarding external influence on election results.

The strategic geopolitical position of Taiwan, coupled with its complex relationship with China, makes it a focal point for regional and global powers. Various scenarios may unfold, shaped by external actors seeking to influence the democratic processes in Taiwan. Firstly, given China’s historical claims over Taiwan and its interest in reunification, the Chinese government will likely deploy subtle or overt tactics involving economic incentives, diplomatic pressure, or disinformation campaigns aimed at shaping public opinion, aiming to sway the elections in favor of candidates perceived as more amenable to Beijing’s agenda.

Conversely, other international players, with an interest in maintaining Taiwan’s autonomy, will actively support candidates aligned with policies promoting independence or a status quo that avoids closer ties with China. This support is manifested through diplomatic endorsements, economic assistance, or collaborative efforts to counter disinformation campaigns. Moreover, the global technological landscape, with Taiwan being a crucial hub for semiconductor manufacturing, adds an economic dimension to external influence, as countries or entities invested in the semiconductor industry have interest to shape Taiwanese policies to safeguard their economic interests, either directly or indirectly. Balancing these influences requires astute political maneuvering, a robust defense of democratic institutions, and a clear articulation of Taiwan’s strategic objectives on the global stage. The scenarios that unfold will not only determine the immediate political landscape in Taiwan but also influence the broader dynamics of the region and the delicate balance of power in East Asia.

Seen from the examples above, it is evident that the global economic impact of the semiconductor shortage is far-reaching, with disruptions affecting sectors worldwide and leading to multi-billion-dollar losses. Supply chain vulnerabilities exposed the interconnectedness of industries reliant on semiconductor components, and scarcity laid bare the fragility of the global supply chain. In essence, the shortage has slowed down technological innovation, affecting the development and release of new products. Industries dependent on cutting-edge technologies, such as 5G networks and advanced consumer electronics, face delays in their rollouts, impacting both businesses and consumers.

Acknowledging the gravity of the issue, governments worldwide are deliberating on or putting into action policy measures in response to the semiconductor shortage. Initiatives focused on enhancing domestic semiconductor manufacturing or fostering international collaborations are indicative of concerted efforts to alleviate the economic impact and fortify future resilience. All these considerations combined reveal that this shortage contributes to a decline in economic output, hindering post-pandemic global recovery.

05

Navigating the Future

05

Navigating the Future

The semiconductors supply chain risks are not merely a transient disruption but a harbinger of a future where adaptability is essential, contingent upon the balance of global powers, outcome of the coming elections, strategic policies, and supply chain resilience.

Considering the technological aspects, navigating the intricacies of the semiconductor landscape, consumers can expect a proliferation of innovative applications. The relentless pursuit of technological innovation, exemplified by the semiconductor industry’s commitment to advancing Moore’s Law,[13] suggests that consumers can expect a future characterized by increasingly powerful and energy-efficient chips, revolutionizing the landscape of devices and technologies that have become integral to daily life and an array of interconnected devices that define the modern technological ecosystem.

Artificial Intelligence, autonomous vehicles, and the Internet of Things are poised to revolutionize sectors like healthcare, transportation, and smart homes. These advancements likely hinge on the continuous evolution of semiconductor technology, promising more powerful, energy-efficient, and even more compact chips.

Also, the intertwining progress of semiconductors and AI marks a transformative era in technological evolution. Their symbiotic relationship is driving innovation, with the future of AI hinging on the development of AI-optimized semiconductor chips. As AI becomes integral to various sectors, including the military, control over advanced AI chips becomes crucial for maintaining technological primacy and national security. This shift not only impacts the technological landscape but also has widespread implications for economic competitiveness on a global scale.

Cyber-attacks undoubtedly pose substantial risks to semiconductor companies and their suppliers due to the ever-growing digitalization and automation of production processes. This dynamic collaboration is expected to fuel substantial growth in the next decade, ushering in a period where advancements in both semiconductors and AI converge to redefine the technological landscape. Therefore, effective management of cyber threats is imperative to prevent the loss of intellectual property and mitigate business impacts.

US-China competition will highly likely influence the semiconductor industry and supply chain. The competition underscores the need for consumers to anticipate potential shifts in the global supply chain as policy interventions, export controls, and strategic collaborations unfold, thereby influencing the sourcing and availability of semiconductor-dependent products on the consumer market.

It is imperative for the US to recalibrate its approach to semiconductor leadership through comprehensive policies encompassing industrial strategy, defense applications, human capital development, export controls, and cooperative endeavors with allies. In addition, consumers must remain attuned to the evolving regulatory landscape, anticipating potential shifts in market dynamics, product innovation trajectories, and the overarching consumer experience within the context of semiconductor-driven technologies.

How can we help?

Intelligence Solutions

The combination of business, market and strategic intelligence ensures result-driven outcomes for our customers.

Risk management

Risk management through the responsibility of taking risk ownership while ensuring safety and security

Strategic Advisory

The first step in protecting your organization, assets and people is the identification of the risks and threats.

The interplay of these factors suggests that consumers ought to brace for a future wherein the semiconductor shortage extends its tendrils into diverse realms, shaping not only the availability and pricing of consumer goods but also influencing the trajectory of technological advancements and the strategic positioning of nations in the global semiconductor landscape. This interaction necessitates a heightened awareness of the intricate interdependencies between geopolitical developments, policy interventions, and the accessibility of semiconductor-enabled innovations in the consumer sphere.

The outcome of the January 2024 Taiwan presidential election holds strategic implications for companies operating in the region, influencing their market positioning and supply chain resilience amid potential shifts in political dynamics. A pro-independence leadership in Taiwan may escalate tensions with China, potentially leading to increased military posturing and geopolitical uncertainties, which would impact global markets, particularly for companies with interests in the region. On the other hand, a pro-reunification stance might ease tensions with China, but this could still lead to shifts in diplomatic and economic relations with other external partners. However, it is likely that the status quo would be maintained in the following period since a pro-independence presidential candidate seems favorable to win the upcoming election.

Likewise, the June 2024 EU election’s results likely play a crucial role in shaping strategic postures, not only in the context of China-Taiwan relations but also in addressing conflicts in Israel and Ukraine, influencing market dynamics for businesses operating in the European market. The rise of far-right politics in Europe would likely impact the EU’s internal cohesion and its strategic posture on the global stage. In terms of China and the Taiwan question, this shift could lead to a more conservative and assertive stance, challenging the prevailing EU policies.

As for the November 2024 US presidential elections, the strategic posture regarding the Taiwan question, Israel, and Ukraine conflicts are poised to shape the future geopolitical landscape. The election outcome will inevitably impact how the United States navigates its relationships, particularly Taiwan, a focal point in US-China relations, will continue to be a key consideration with the stance taken by the incoming administration influencing diplomatic and global security dynamics.

To sum it all up, the semiconductor shortage, a complex tapestry woven by the confluence of heightened demand during the COVID-19 pandemic, trade dominance, and geopolitical dynamics, signals a future where consumers must navigate a landscape marked by potential delays, pricing fluctuations, and challenges in accessing cutting-edge products. The scarcity of semiconductors, reverberating across crucial industries, necessitates a pragmatic approach to technological expectations. The evolving geopolitical rivalry is urging consumers to remain vigilant to shifts in the global supply chain, market dynamics, and regulatory frameworks, as well as the power balance in the world’s geopolitical hotspots.

ARTICLE | 25 PAGES

Silicon Struggles:

Navigating the Geopolitical Maze

of Semiconductor Challenges

To get the PDF version of this analysis, please contact us at order@dynamicsintl.com

ARTICLE | 25 PAGES